5 Common Barriers to Efficient Claims Management for Health Plans

What does it take to pay a claim correctly? In healthcare, “editing claims” goes beyond surface-level checks—it’s about ensuring accuracy, compliance, and efficiency. Each claim must align with provider contracts, state and federal regulations, and demonstrate medical necessity. The challenge for many health plans lies in navigating the diverse payment policies while minimizing delays or rework. Payment integrity is about maintaining this intricate balance.

Payment accuracy, operational efficiency, and cost management are critical priorities for health plans navigating an increasingly complex claims landscape. Errors in claims processing can disrupt operational workflows, increase expenses, and damage relationships with healthcare providers.

In the recent webinar, “Path to Payment Integrity: Enhance Payment Accuracy with HealthEdge Source™ Editing,” our experts shared actionable ways payers can address common challenges to claims accuracy. This blog will explore 5 of the key obstacles health plans face during claims processing and how the HealthEdge Source Editing tool helps contribute to cost savings by enhancing accuracy and efficiency.

5 Challenges Health Plans Face in Claims Management

The claims payment process often involves multiple, disparate technologies. Juggling multiple vendors and point solutions can lead to workflow inefficiencies and increased operating costs. If claims management feels overwhelming, you’re not alone. These are 5 of the most common challenges payers face.

1. Regulatory Complexity

Keeping up with constant updates from the Centers for Medicare and Medicaid Services (CMS), state Medicaid programs, and other federal agencies requires meticulous oversight and prompt action. Health plans often struggle to keep up with the pace of change, leading to non-compliance risks and operational disruption.

2. Too Many Vendors

Health plans rely on a fragmented approach with multiple vendors managing separate parts of post-pay processes. This “stacked vendor” system can lead to inefficiencies, delayed guideline updates, varying data accuracy, and higher administrative costs.

3. Rising Administrative Costs

On average, each medical claim carries a financial cost of $12 to $19. Complex manual processes and workflow inefficiencies in claim processing can significantly increase these administrative costs. Reliance on manual claims processing also causes issues for health systems, costing an average of $5 million in losses per year and increasing provider abrasion.

4. Limited Internal Claims Editing Capabilities

Many health plans lack effective in-house tools to align claims editing and pricing systems. Relying on disparate third-party claims editing systems can create mismatches between pricing, policies, and regulations—leading to denials and rework.

5. Provider Abrasion

Delays, rework, and reimbursement issues damage provider trust in your health plan, making an already complex system even harder to manage.

Payment Integrity Insights from Payers

During the webinar, participants were surveyed about the top challenges and priorities at their health plans.

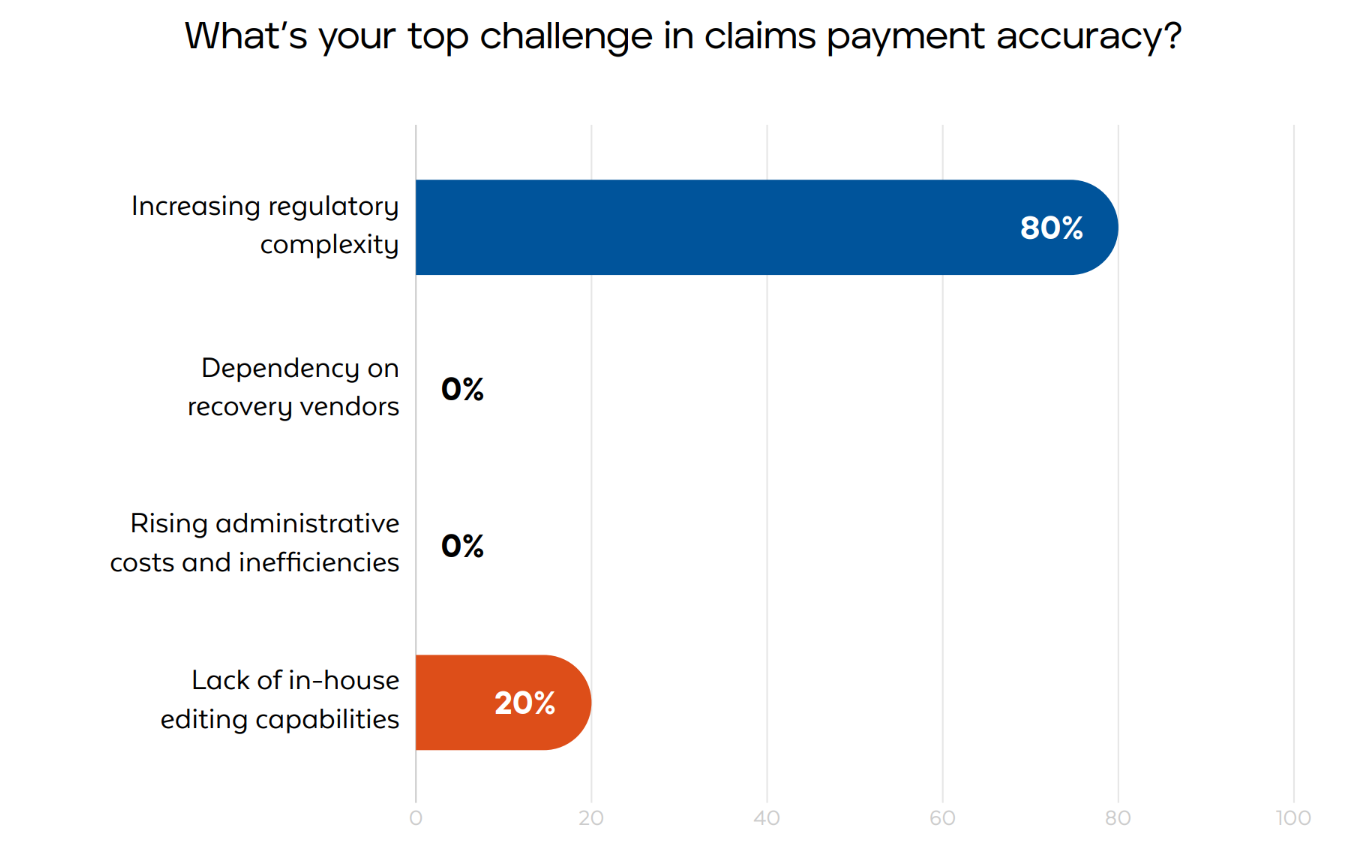

Top Challenges in Claims Payment Accuracy

“Increasing regulatory complexity” emerged as a primary concern for payers, followed closely by a “lack of in-house claims editing capabilities.” These findings highlight that staying compliant while managing cost and operational efficiency remains a delicate balance.

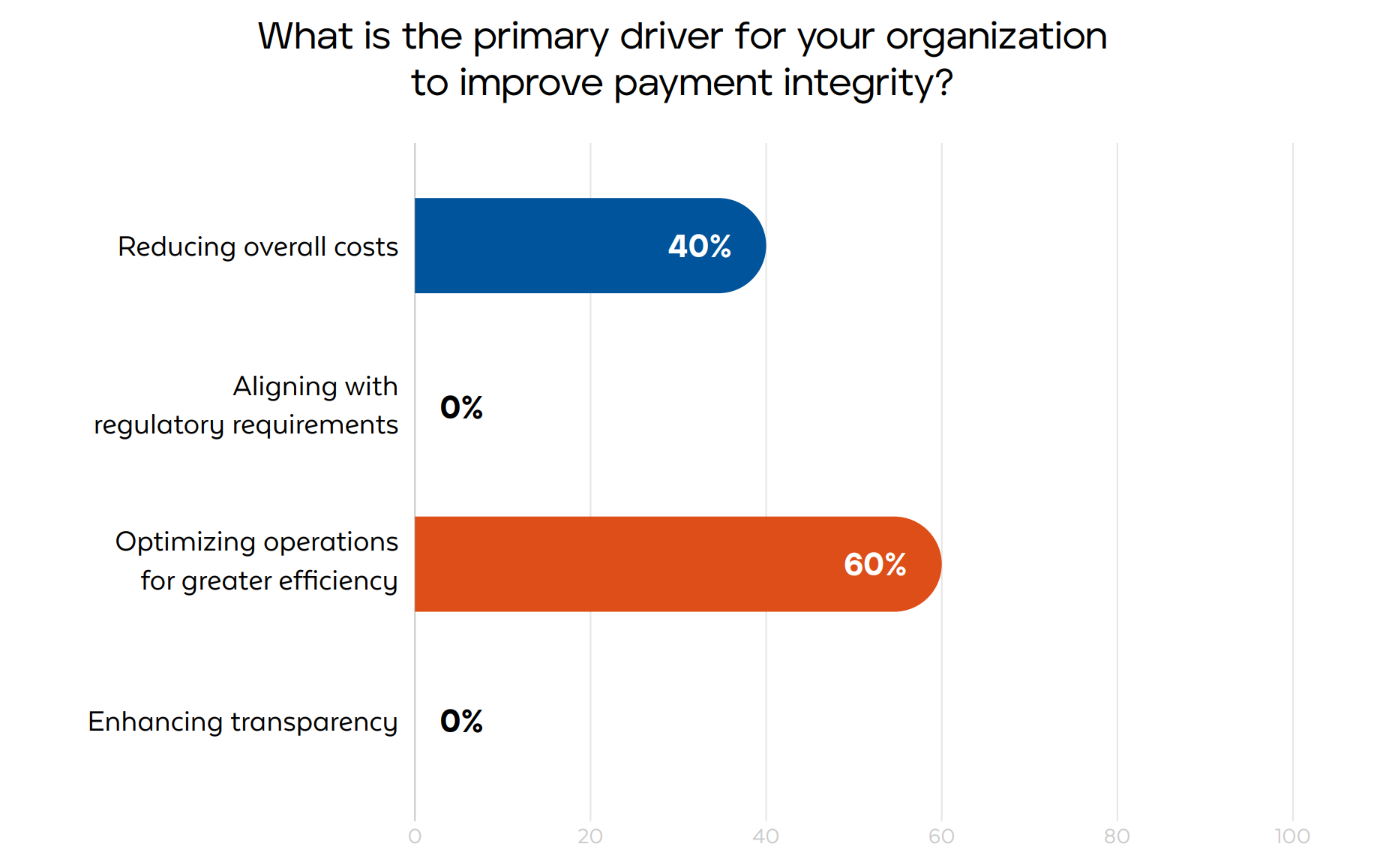

Primary Drivers for Improving Payment Integrity

Many payers identified “reducing overall costs” and “optimizing operations for efficiency” as the main drivers for modernizing payment integrity efforts. These priorities go hand-in-hand as health plans strive to streamline workflows and eliminate wasteful spending.

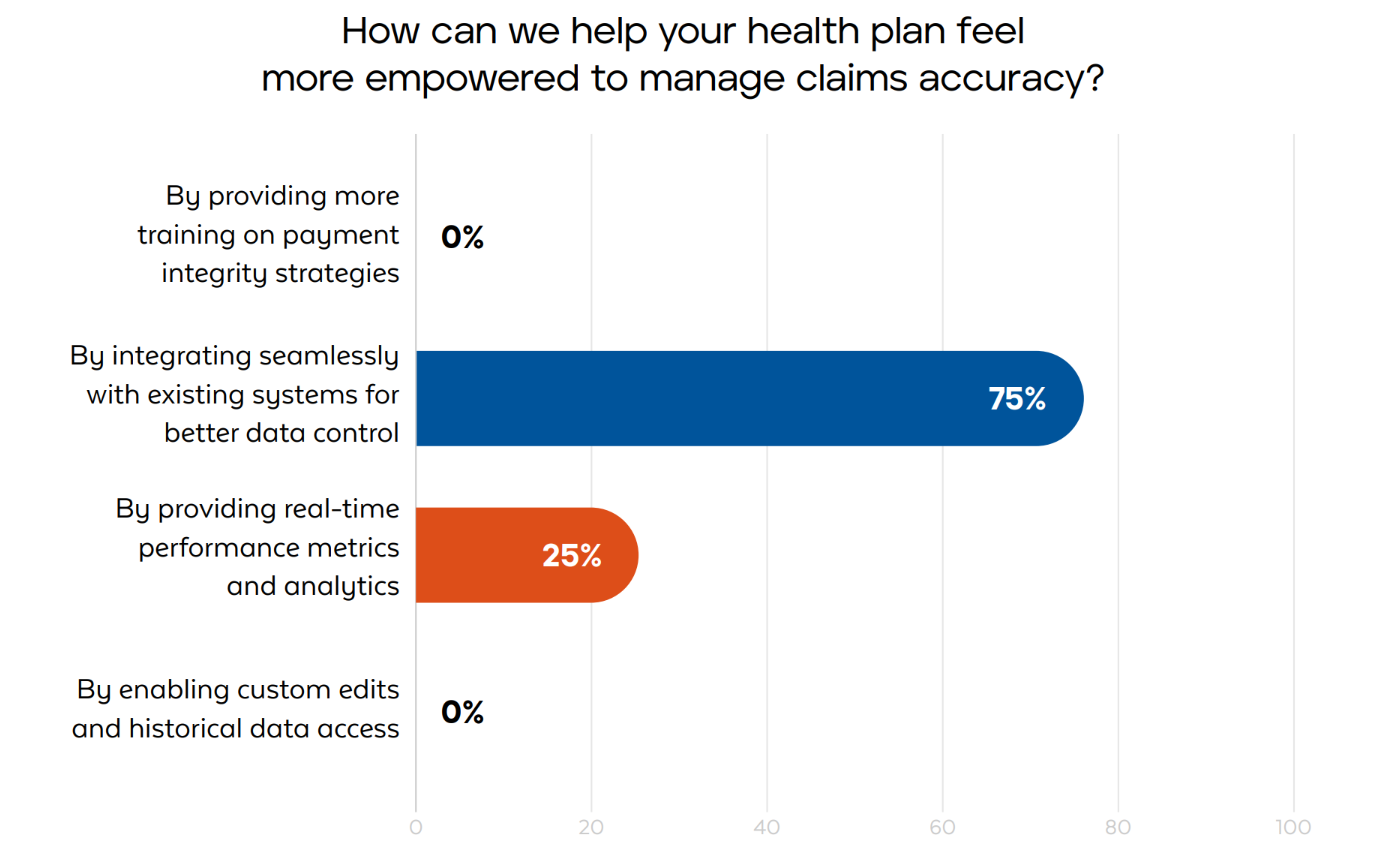

Most Helpful Tools for Claims Accuracy

Participants emphasized the need for “real-time performance metrics” and “stronger system integrations” as critical enablers for success. Streamlined insights and a cohesive ecosystem are essential for navigating the complexities of payment integrity.

Benefits of HealthEdge Source Editing

Real-Time Claims Accuracy

With HealthEdge Source Editing, claims processing is automated to streamline operations and reduce the need for manual review. Automating processes helps cut down on expensive claims rework and reduces provider abrasion due to delays.

HealthEdge Source combines editing, pricing, and analytics into one integrated system, catching errors and flagging inconsistencies in real-time. This proactive approach uncovers the root causes behind recurring payment issues. With these insights, health plans can fine-tune their processes, implement corrective strategies, and address systemic inefficiencies, all while maintaining a clear focus on cost containment and operational excellence.

Regulatory Compliance Made Easy

HealthEdge Source simplifies compliance for your team through automatic cloud-based, regulatory updates, eliminating the burden on your internal teams. With constantly updated code edits, automated claims auditing, and detailed audit trails, staying compliant has never been easier.

The platform is fully customizable for state and payer-specific requirements, giving your health plan the flexibility to adapt to shifting guidelines. By automating compliance checks, HealthEdge Source can help minimize penalties, save time, and enhance accuracy—letting you focus on your members.

Seamless Integration

Our solution seamlessly integrates with existing claims systems, third-party tools[DN1] , and pricers to enhance capabilities without costly disruptions. Third-party integrations make it easier for payers to streamline data flow, eliminate silos, and enable real-time validation, ensuring accurate claims processing and payment calculations upfront. Leveraging third-party tools also helps improve fraud detection and data enrichment. The result is a cohesive ecosystem that allows your health plan to deliver both financial and operational excellence without compromise.

Increased Customization and Control

HealthEdge Source Editing allows your health plan to tailor rules and configurations to match unique provider contracts, policies, and regulatory requirements. This flexibility improves accuracy while helping payers adapt to evolving business needs.

Actionable Business Intelligence

The HealthEdge Source platform provides transparent insights into claims performance through a unified interface. The modeling tool allows health plan teams to test and refine new edits before implementation, reducing errors and ensuring alignment with business goals. And advanced analytics highlight trends and potential challenges, enabling health plans to make data-driven decisions and proactively adapt to emerging demands.

Efficiency and Cost Savings

By streamlining payment integrity operations, HealthEdge Source Editing helps payers reduce administrative costs and save time. This allows internal teams to focus on strategic initiatives, rather than repeatedly fighting the same fires.

HealthEdge Source Editing provides a comprehensive solution that combines real-time accuracy, seamless integration, regulatory adaptability, and actionable insights, enabling your organization to streamline processes, reduce costs, and build stronger relationships with providers.

Watch the video to see how your health plan can leverage HealthEdge Source Editing.

Ready to learn more about HealthEdge Source? Explore what the solution can do for your health plan by visiting our resources page for additional tools, insights, and expert guidance. Empower your organization to deliver excellence in payment integrity today.