Why Nearly One-Third of Consumers May Change Health Insurance Carriers in the Next Year

A staggering 29% of healthcare consumers said they intend to change health insurance carriers in the coming year, signaling a wake-up call for the industry.

HealthEdge conducts an annual nationwide study to help health plans understand their members’ needs and expectations for healthcare services. This year, we surveyed more than 3,500 healthcare consumer—and almost one-third are considering switching health insurers next year.

The findings highlight an immediate need for health plans to prioritize member satisfaction. To remain competitive amid a rapidly shifting healthcare industry, health plans must innovate to attract and retain membership.

“Rising healthcare costs and more choices for consumers puts health plan members in the driver’s seat.”

-Alan Stein, Chief Product and Strategy Officer at HealthEdge

The Age of Choice and Churn

Consumers now have more health insurance choices than ever before. For example, the Affordable Care Act (ACA) Marketplace is currently providing private health insurance to 21.3 million consumers, with 92% of them having the option to choose from, on average, three different insurance plans. Additionally, this year, Medicare beneficiaries had an average of 43 Medicare Advantage plan choices available to them.

The age of consumer choice in health insurance is here, making it crucial for health plans to put member satisfaction at the forefront of their digital transformation strategies.

According to Alan Stein, Chief Product and Strategy Officer at HealthEdge, “At HealthEdge, we are working with health plans to address critical challenges across the landscape. Those challenges range from rising healthcare costs and more choices for consumers which puts health plan members in the driver’s seat. Now more than ever, members are expecting more from their insurers. This latest survey highlights the importance of investment in personalized plans that meet members where they are.”

Which Members are More Likely to Change Health Insurance Carriers?

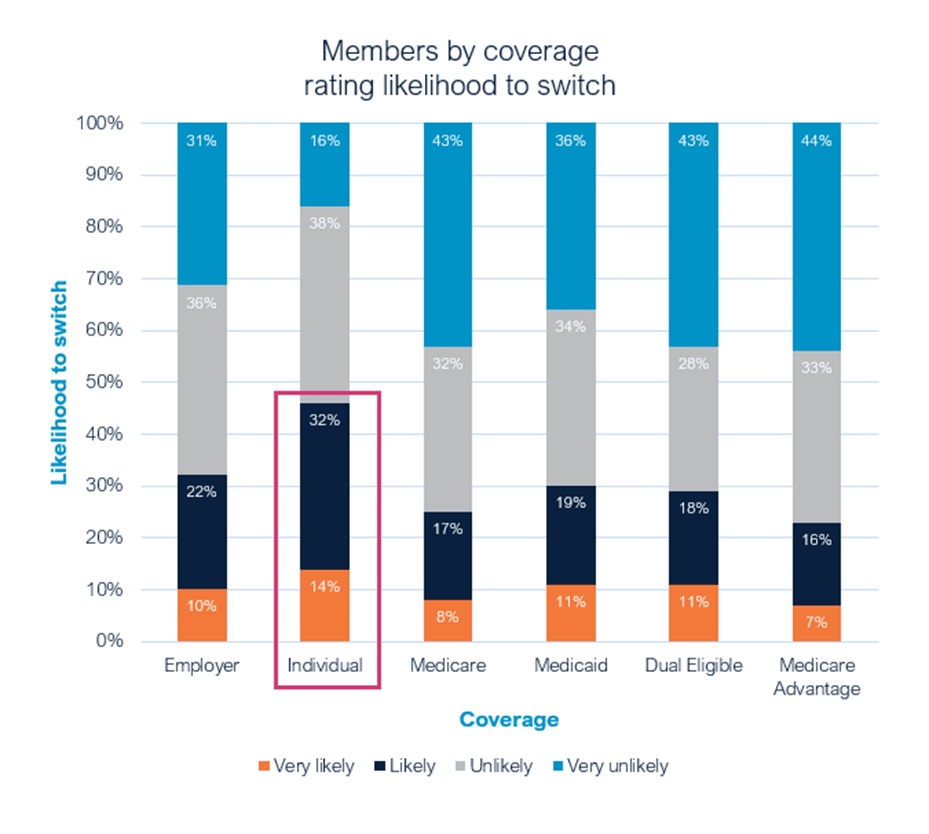

Members with individual and employer-sponsored coverage are the most likely to switch, highlighting the urgency for health plans to prioritize member satisfaction initiatives.

It’s not surprising that individual consumers might want to change health insurance carriers, especially with ACA Marketplace enrollment reaching record highs and generating significant activity in this sector. Medicare Advantage members are another group known for frequent health plan changes, with 23% indicating they are “very likely” or “likely” to switch health plans next year.

Age also affects the healthcare consumers’ willingness to switch health insurance plans. Health plan members aged 26–45 are the most likely to change health insurance carriers. This may be attributed to their life stage, which often involves more frequent job transitions, the onset of health issues, and a growing awareness of the financial responsibilities tied to healthcare utilization.

The Opportunity for Health Plans: Catching Members that Change Health Insurance Carriers

There are an increasing number of options members can choose from and a growing demand for more personalized care. Modern health plans that have empowered their teams with the right digital tools have an opportunity to attract more than their fair share of these moving populations

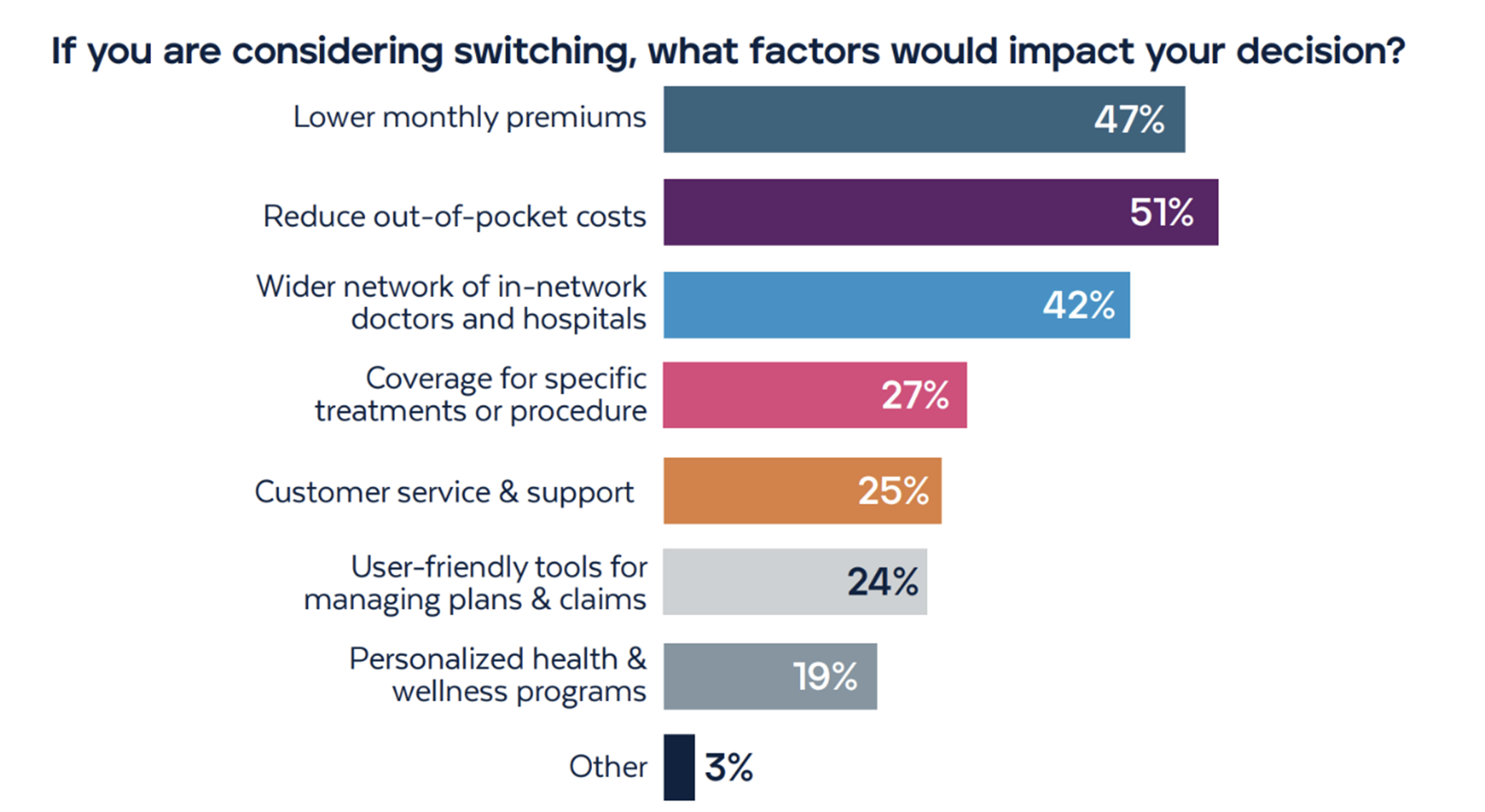

We asked consumers what would impact their decision to switch health plans. The most popular responses centered around cost-related factors, network coverage, and customer service/access to self-service tools.

How can Health Plans Mitigate the Risk of High Member Churn Rates?

Beyond lower monthly premiums and out-of-pocket costs, members want to ensure they have access to a wide range of in-network doctors and hospitals. Health plans with strong networks have the opportunity to ensure members receive timely, quality care from the right providers, thus improving their experiences and streamlining care coordination for improve health outcomes.

The survey revealed that health insurance coverage plays a significant role in healthcare decisions for many consumers:

- 57% reported that their coverage often or always influences their decisions on when to seek care.

- 46% indicated that their coverage impacts their choices regarding where to receive care.

- 32% have considered changing care providers due to their in-network coverage.

Members also want clarity and accessibility when it comes to their health insurance information. This includes understanding the cost of medical services. In fact, only 25% of respondents were fully satisfied with their health plan’s ability to provide this clarity.

Modern care management platforms allow health plans to meet regulatory requirements while empowering members with the insights and estimates they need to make informed healthcare decisions. These solutions provide members with self-service tools, such as portals and mobile applications, granting them enhanced control and access to their individual health plan information.

Insights on Health Plan Member Technology Adoption

The survey indicates a strong acceptance of technology among members, with 64% saying they are comfortable using secure mobile apps for health plan interactions and record tracking. This comfort spans across age demographics, led by the middle-aged group (ages 36-55) at 73%. A notable 50% of older adults (ages 56+) also embracing mobile app usage. This trend is consistent across plan types as well, with Medicaid plan members showing the highest comfort at 69%, followed closely by those with employer-sponsored (70%) and individually purchased plans (74%).

Digital care management solutions are transforming health plans by streamlining operations, fostering collaborative relationships with provider networks, and enhancing member and care manager engagement. These solutions provide critical information that supports personalized care and promotes transparency—empowering your health plan to retain members and capture new members looking to chance health insurance carriers.

To learn more about these consumer trends, download the full report: 2024 Consumer Survey: Key Trends in Healthcare Member Expectations and Satisfaction.