Improve Pre-Pay Accuracy with Prospective Payment Integrity Solution

The traditional post-pay model has long been the standard in healthcare claims adjudication. However, it can result in significant administrative burdens and increased costs for healthcare payers. Providers are left to deal with the impacts, such as claim rejections that lead to financial setbacks and strained relationships.

A pre-pay model offers a solution by resolving errors before claims are paid. This proactive approach reduces costs and enhances the experience for payers and providers. By streamlining workflows and implementing robust pre-payment processes, health plans can expedite claims processing while reducing unnecessary payments and appeals.

Industry Trends Driving the Shift to Pre-Pay Review

As an industry, the increased focus on care quality and efficiency is changing how health plans deliver and reimburse for care services. As payers and providers strive to improve outcomes without increasing costs, 4 key components have emerged as most influential in supporting pre-pay initiatives.

- Value-Based Care: The shift toward value-based care models from fee-for-service highlights the need for accurate and timely payments. Pre-pay review supports this trend by making sure that providers are fairly compensated for the value of the care they deliver—thereby helping improve outcomes while controlling costs.

- Risk Adjustment: Risk adjustment models are becoming increasingly complex, making accurate coding and documentation crucial for maximizing revenue. Pre-pay review helps identify and correct coding errors before claims are submitted.

- Advanced Analytics: The availability of data and advanced analytics tools allows health plans to identify potential issues with claims more efficiently. This powers predictive models that can flag high-risk claims for pre-pay review, enabling health plans to address problems before they escalate. This proactive approach reduces the likelihood of claim denials and rework.

- Regulatory Compliance: Healthcare payers operate within a complex regulatory environment. Pre-pay review helps health plans ensure compliance with fraud, waste, and abuse regulations. By addressing issues upfront, health plans can avoid costly penalties and maintain a high standard of integrity.

Benefits of a Pre-Pay Model

A pre-pay model facilitates accurate claims reimbursements, helping payers accelerate transactions, identify root causes of incorrect payments, and decrease claim denial rates. It is a step forward in creating a more optimized and cost-effective payment ecosystem. Primary advantages of a pre-pay model include:

- Claim Accuracy: Reduces errors and denials by proactively verifying eligibility, medical necessity, and authorizations before payment.

- Administrative Efficiency: Minimizes manual intervention and risk of rework by identifying and addressing issues before claim submission.

- Cost Control: Prevents unnecessary services and detects fraud early, which can lead to substantial cost savings.

- Provider Relationships: Timely claim payments, fewer denials, and transparent communication foster trust and build strong provider relationships. Health plans that prioritize accuracy and efficiency in claims processing are more likely to retain high-quality provider networks.

Challenges with Implementing a Pre-Pay Model

Implementing new processes and solutions can be complicated. From earning team buy-in and managing expectations to training and adoption, there are several hurdles health plans might face. But the right technology partner should be able to answer your questions and support your organization throughout the implementation process.

Data Integration

Integrating different data sources can be a major obstacle in implementing a pre-pay model. Health plans often rely on outdated systems that struggle to communicate with each other, impacting the accuracy and speed of pre-payment claim reviews. Leveraging an integrated payment integrity solution can facilitate data-sharing and claims processing.

Technical Barriers

Setting up and configuring new systems can be cumbersome and time-consuming. Upgrading infrastructure, implementing advanced analytics, and retraining staff require significant financial and time investments. Organizational buy-in is crucial to overcome adoption roadblocks.

Financial Considerations

Shifting to pre-payment requires upfront capital for new systems and ongoing operational costs. Despite the promising long-term benefits of a pre-pay model, health plans must carefully consider the financial implications of such a transition and prioritize their adoption timelines accordingly.

Cultural Transformation

Implementing a pre-pay model requires a cultural transformation within the organization. Employees must adapt to new roles and responsibilities, and health plans must foster a culture of continuous improvement and innovation. Effective change management strategies from the beginning of the process are vital for maintaining long-term commitment.

Prospective Payment Integrity Solution for Pre-Pay Accuracy

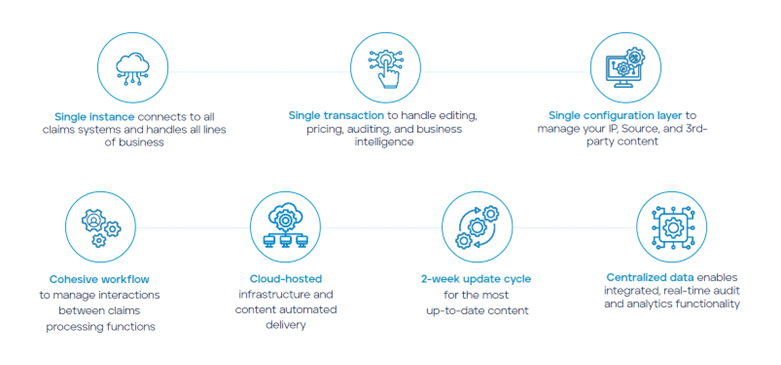

To make this transition easier, we have designed HealthEdge Source™, an integrated prospective payment integrity solution. Source can support payers across all lines of business, providing real-time claims audits and analytics while addressing common challenges associated with pre-pay implementation.

The Source platform can enable the transition to a pre-pay model through:

- Data Integration and Standardization: Leverage up-to-date information from claims, members, providers, and contracts—all seamlessly combined and standardized accurate analysis.

- Comprehensive Content Library: Access the latest clinical, coding, and payer guidelines, updated bi-weekly to ensure claim accuracy. This comprehensive content library helps health plans stay current with industry standards and best practices.

- Advanced Automation: Accelerate claim processing through real-time, cloud-based editing and pricing features that reduce manual intervention.

- Robust Analytics: Identify trends, patterns, and anomalies across your payments data to inform data-driven decisions and workflow optimization.

- Flexible Configuration: Adapt to your health plan’s unique needs with flexible and user-friendly configuration options.

- Reduced Vendor Dependency: Manage edits in-house and increase how much control your plan has over payment integrity.

How HealthEdge Source Supports Pre-Pay Review

Identifying Potential Issues Early

By applying comprehensive edits and analytics, Source can flag claims with potential errors before payment is issued. This early identification helps prevent costly mistakes and reduces the need for rework.

Improving Claim Accuracy

Addressing upfront issues helps reduce claim denials, appeals, and rework, leading to increased claim accuracy. Health plans can ensure that claims are processed correctly the first time, enhancing overall efficiency.

Enhancing Operational Efficiency

Automation and streamlined workflows contribute to faster claim processing and reduced administrative costs. Health plans can allocate resources more effectively, focusing on strategic initiatives rather than manual claim reviews.

Supporting Data-Driven Decision-Making

Source provides valuable insights into claim trends and performance metrics, enabling data-driven improvements to the pre-pay review process. Health plans can use this information to continually refine their processes and achieve better outcomes.

Adopting a new payment model comes with distinct challenges, but your health plan doesn’t have to do it alone. HealthEdge Source offers more than just a solution for payment integrity—it helps drive enterprise-wide transformation. By optimizing workflows and establishing strong pre-payment processes, health plans can expedite claims processing while minimizing unnecessary payments and appeals.

Check out additional resources and learn how to enhance your health plan’s efficiency and reduce costly errors.