How to Achieve Claims Automation for Health Plans

Step 1: Objectively Measure Impact of “Stacking” vs Prospective Payment Integrity

With complementary access to Gartner® research, Adopt Prospective Payment Integrity to Thwart Healthcare Fraud and Improper Claims Payment

“Improper claims payment and fraud contribute more than $200 billion to the annual cost of U.S. healthcare…”.1 Here’s what health plans can do to address it.

Recommendations

To achieve prospective payment integrity, health plan CIOs should:

- Quantify the value of current “stacking” or other payment integrity efforts. Do this by establishing a comprehensive and in-depth ROI analysis, including metrics from:

- Finance

- PNM

- SIU

- Claims Leadership

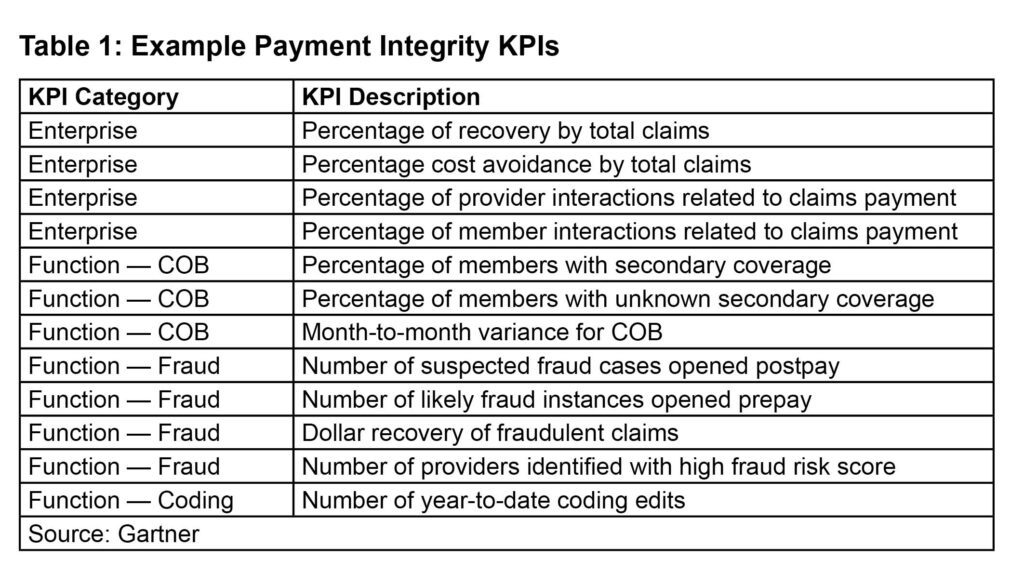

2. Capture key performance indicators (KPIs). Identify methods used to achieve KPIs and how to measure success.

Who should establish objective impact? What team members should be consulted?

Implementing prospective payment solutions can be challenging because it requires buy-in from stakeholders across the health plan enterprise.

All business leaders across the enterprise who are responsible or accountable for payment integrity initiatives should be consulted when conducting an ROI analysis and KPIs. This includes professionals in:

- “IT (including reporting and analytics functions)

- Finance and actuary

- Compliance

- Claims

- Network management (including provider relationship management)

- Medical management

- Customer service (provider and member, as payment integrity affects both constituencies)

- Vendor management

- Specialty business management

- Legal

- Delegated entities”

To spearhead ROI and KPI analyses, CIOs should establish a formal committee made up of leaders in each of these departments. Gartner research states that together they should determine:

- “What are the specific objectives of the department’s payment integrity effort? For example, is the goal to open 20 new investigation cases per month or recover $5 million over 12 months?

- What types of payment integrity processes are in use to meet the objectives (that is, retrospective, prospective or preemptive) and are they delivering on their promise?

- What solution partners are assisting the department in addressing payment integrity and are they performing up to expectations?

- How does the business unit measure and report payment integrity performance and how are those metrics trending?

- Do the existing solution partners have performance requirements and incentives as part of their contracts, what are they, and are the goals being achieved?”1

Establish Company-Wide KPIs

Once the above questions are answered, your committee should record each business unit’s specific KPIs related to payment integrity. They should also note how these KPIs are measured and achieved.

Highlight the KPIs which are:

- Uniform across business units

- Related to payment integrity goals

- Impact customer experience (cx)

Notes: Claims payment accuracy and timeliness significantly affect provider and member relationships.

Customer experience is especially important because poor provider/partner and purchaser alignment can influence revenue-generating activities, such as network contract negotiations and large group renewals. Customer experience also impacts:

- Net Promoter Score (NPS) for members and providers

- Consumer Assessment of Healthcare Providers and Systems (CAHPS) scores

- Medicare Advantage Star ratings on health plan experience measures

- Rate of grievance and appeals

- Membership churn

- Network adequacy gaps

If the payment integrity and customer experience objectives are fragmented between departments, consult with c-suite executives to define enterprise-wide corporate goals. Create a final list of goals related to KPIs that considers stakeholder responses.

Your final list of goals and related KPIs could include:

- Decrease the current claims spend

- Reduce the percentage of claims requiring rework (goal)

- Reduce the cost per claim processed (goal)

- Reduce claims-related provider call volume

- Reduce member touchpoints

- See more in the table below.

How to Start Investing in Prospective Payment Integrity Solutions Today

By developing a dedicated committee to determine cost-benefit of “stacking” strategies vs prospective payment solutions as well as establishing company-wide KPIs, you’ll overcome barriers to adoption.

The next step to payment integrity is to issue an RFP. Your committee should then evaluate current or possible vendor capabilities for improving cost avoidance as well as enhancing business and provider partnerships. (learn more)

To learn more, get complimentary access to Gartner research here.

1Gartner, Adopt Prospective Payment Integrity to Thwart Healthcare Fraud and Improper Claims Payment, February 16, 2022

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.