Become

a Digital Payer

What is a digital payer?

Although digitization has dramatically transformed many sectors – notably in commerce and other service industries – it has yet to really make an impact on healthcare.

Overburdened with the growing complexities of compliance and new payment models along with rising health consumer expectations for greater access and transparency, now is time for healthcare payers to embrace digitization.

Becoming a digital health payer requires modern digital healthcare software that creates transformational consumer experiences and payer business agility.

To meet these consumer demands, payers need to become digital payers.

Transforming payer relationships at all levels

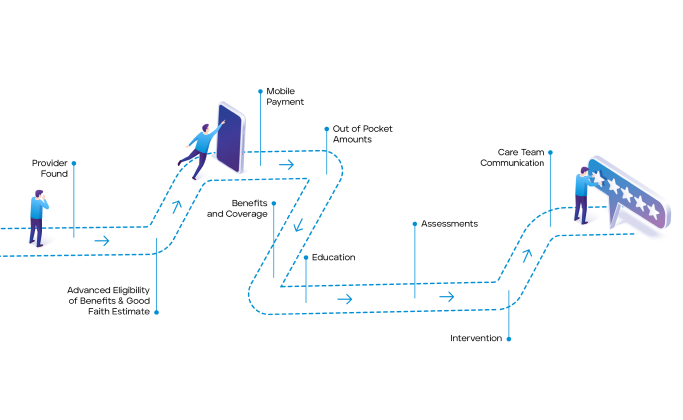

The Member Experience

Instead of disjointed, confusing interactions via traditional means (telephone, emails, portals), members can choose to access powerful self-service tools or engage directly with highly informed representatives via the same modern means they’ve come to expect from their retail experiences with companies like Amazon and Google.

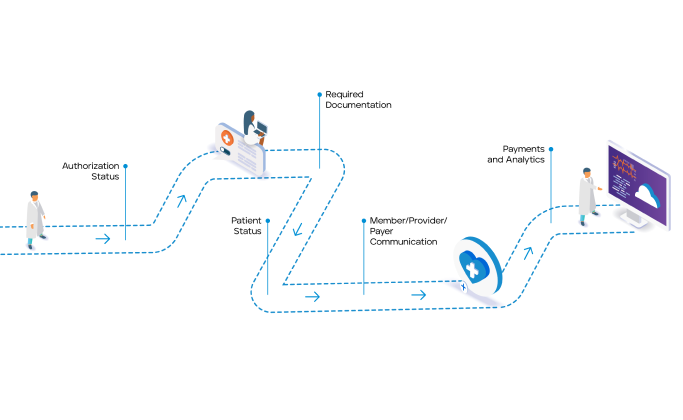

The Provider Experience

Instead of manual-intensive interactions with payers that are stifled by latent data and lengthy authorization and claims payment processes, providers can get instant access to real-time data on patient benefit plans to expedite care and optimize health and financial outcomes for everyone.

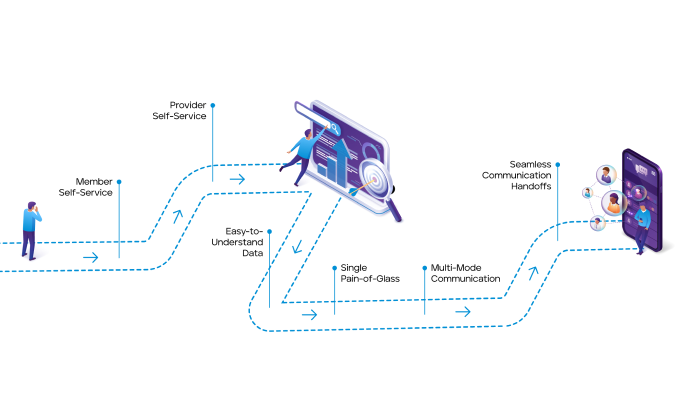

The Member Services Experience

Instead of wasting hours on hold and struggling to get complete answers to provider and member questions, member service reps can off-load repetitive workloads to automated digital healthcare software and spend quality time triaging the exceptions – all from a single screen that presents the right information at the right time.

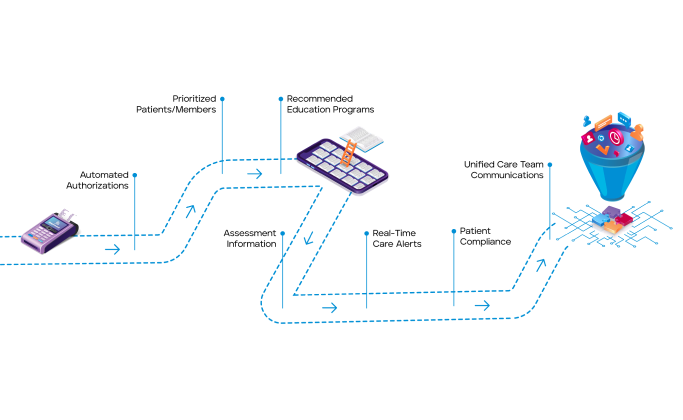

The Care Manager Experience

Instead of hunting for member data across multiple systems to support member needs and compliance requirements, care managers can easily get a real-time picture of member activity from IoT devices and clinical SMEs to optimize care plans and engage members more holistically.

A new era for health plans

By using our digital healthcare software to automate business workflows and seamlessly exchange data in real-time across the ecosystem, HealthEdge customers experience the business attributes of improved end user and consumer centricity, ever reducing transaction costs, ever increasing quality, ever increasing service levels, and business transparency.

Case Study: Digital Automation of Claims Reimbursement Processes at Scale

See how the HealthEdge digital healthcare platform empowered this top-15 insurance company to streamline operations and expand its reach into new markets.

READ CASE STUDY