Technology use among seniors saw significant gains over the last several years, fueled in part by a desire to stay connected during the COVID pandemic. A research study performed by AARP showed 84% of adults over the age of 50 own smartphones, up from 77% in 2019. Ownership of other devices, including tablets, smart TV’s, home assistants, wearables, and smart home technologies, have seen double-digit increases among the same population since 2019.

Technology as a Lifeline

A report from the National Academies of Sciences, Engineering, and Medicine (NASEM) points out that nearly one-fourth of adults aged 65 and older are socially isolated. Older adults are at increased risk for loneliness and social isolation because they are more likely to experience the loss of family or friends, chronic illness, or hearing loss.

Living alone, a reality for approximately one in three older adults living in the US, is another factor impacting loneliness and social isolation. Despite this, three out of four of the adults surveyed want to stay in their homes and age in place as told by Susan Beaton, VP of Health Plan Strategy at Wellframe, in the webinar How health plans can enhance engagement with senior members using technology. For these seniors, technology can help them connect to family, friends and even healthcare providers.

During the COVID pandemic, technology became a lifeline for everyone, but the senior population likely made the biggest strides in usage and adoption. Technology became, and continues to be, a lifeline for aging Americans – whether it’s meeting their emotional needs by connecting with loved ones or helping to enhance their medical care through virtual appointments and other digital interactions with their healthcare providers.

Increased Health & Wellness

The ability for seniors to adopt technology and leverage health-related innovations may lead to positive effects on their health and wellness. The opportunities for these gains, while seemingly small, can add up to make a big impact in overall health.

- Utilization of wearables might encourage seniors to be more active and can clue them into changes in heart rate, blood pressure, temperature or even sleep quality – alerting them earlier to potential health issues.

- Managing and adhering to medications can be challenging for aging adults, but technology can help to issue reminders and monitor usage and even alert caregivers when a dose is missed.

- Telehealth usage peaked over the last years and continues to be an option for delivering healthcare services to older adults in a convenient and cost-efficient manner. Virtual visits mean fewer trips outside the home, less exposure to Covid-19 and other illnesses, and better chances of being seen sooner.

Increasing Technology Use for Seniors

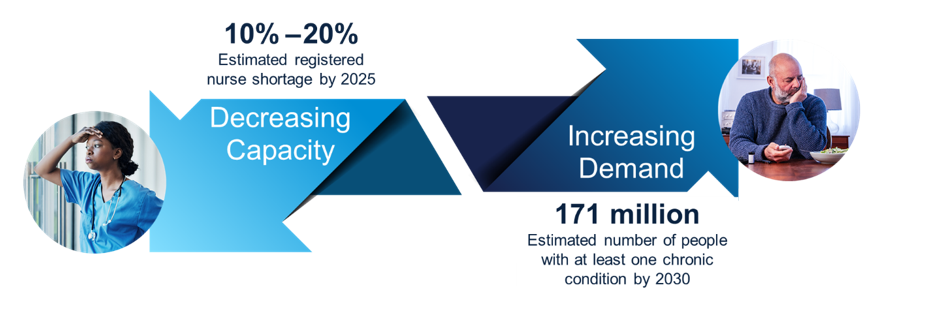

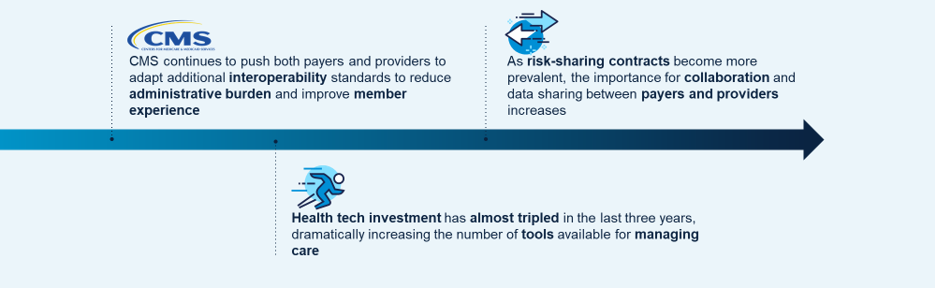

Engaging seniors through technology can be challenging and requires unique approaches to overcoming hurdles. There may be a learning curve to new technology and some individuals may feel overwhelmed. Seniors living on fixed incomes may not have the financial resources to purchase new technologies. Despite this, many payer organizations who recognize the benefits are finding innovative solutions to ensure the members they serve have the tools they need to engage.

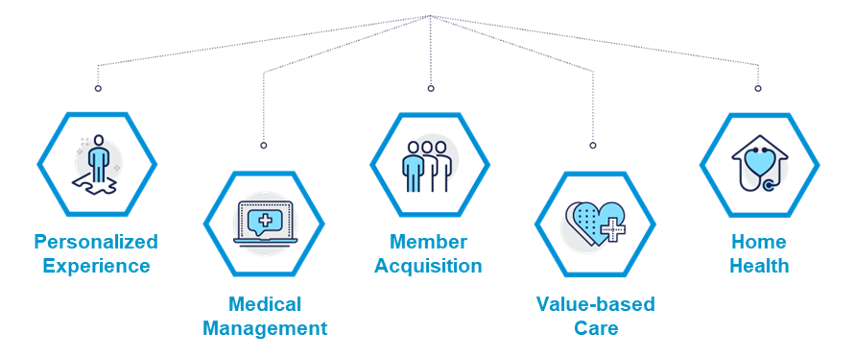

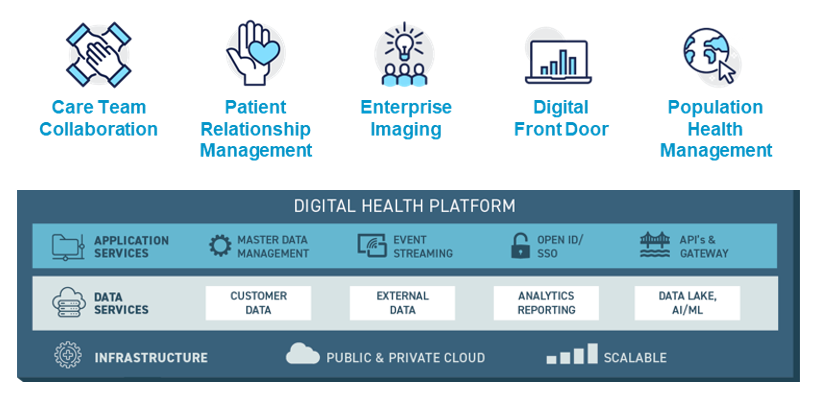

The Right Platform: Wellframe

The Wellframe digital health management platform powers health plans and senior members to achieve their best. It helps organizations extend their reach across more critical touchpoints, uncover, valuable health insights, and deliver modern member services that improve member engagement and experience. Learn more here.