The Importance of Leading & Living with Empathy

When people feel cared for, valued, and supported, they tend to:

- Perform better

- Have stronger bonds with leadership and the organization

- Be more committed to the company’s mission

Empathy is an increasingly important skill, with particular emphasis on establishing bonds between employees, leadership, and company values. Empathy is humble curiosity. It is a skill set fundamental to emotional intelligence, resilience and building strong, trusting professional relationships. It is the ability to identify other people’s challenges and see them from their perspective.

Empathy’s Positive Impacts

A Catalyst study surveying 889 employees found empathy significantly impacts production in the following ways:

- Innovation: People who reported having empathetic leaders were 48% more likely to be innovative.

- Engagement: 76% of team members who experienced empathy from leaders reported they were more engaged at work compared to only 32% of those who experienced less empathy.

- Retention: 57% of white women and 62% of women of color said they were unlikely to leave their companies when life circumstances were respected and valued in the workplace.

- Inclusivity: 50% of workers with empathetic leaders reported their workplace as inclusive, compared with only 17% of those with less empathetic leadership.

- Work-Life Balance: When people perceived leaders as more empathetic, 86% of employees reported they were able to better navigate demands of work and life. In contrast, only 60% of people with less empathetic leadership felt this same level of competency.

Empathy is not only important for teams and leadership but also for customer interactions. Empathy better aligns us with consumer perspectives, allowing companies to better understand pain points and provide optimal solutions.

What can we do to manage teams with greater compassion and understanding to improve communication, increase productivity, and enhance team morale? Here are five tips for leaders and teammates to develop empathy within your organization.

1. Value People Not Just Deliverables

It’s common to focus on deliverables and attribute missed deadlines to individual productivity – instead of personal challenges. This establishes a void between leaders and who they lead, and staff feel less valued.

Take the time to understand what is really driving your team member’s performance or under performance.

“Empathy is about being concerned about the human being, not just about the output.” — Simon Sinek

2. Increase Active Listening

Active listening is essential to building an empathetic workplace. What are your intentions when listening? While they are talking – are you brainstorming ways to fix their problems or counteract their arguments?

Listen to understand and learn, versus listening to ‘fix’.

3. Prioritize Clear Communication

In a recent study, researchers asked a group of workers, “What do you need more of to feel like you can be your best at work?” The only consistent response was clearer communication from leaders. To achieve this:

- Provide transparency and ongoing status updates

- Clarify roles and goals for team members

- Ask how people are doing

- Have open conversations about stress and other challenging topics

- Talk about a time when you overcame a workplace challenge

4. Avoid Judgement and Assumptions

Judgements and stereotypes, impede empathy in the workplace. Avoid making assumptions about your colleagues. Give your teammates the benefit of the doubt before forming opinions.

5. Recognize Feelings

Work can be stressful. Some handle stress better than others. Be mindful of how you speak and react to colleagues. Consider their workloads, and lives outside of work. Try to always communicate with respect and kindness. You will notice that speaking with empathy is more effective.

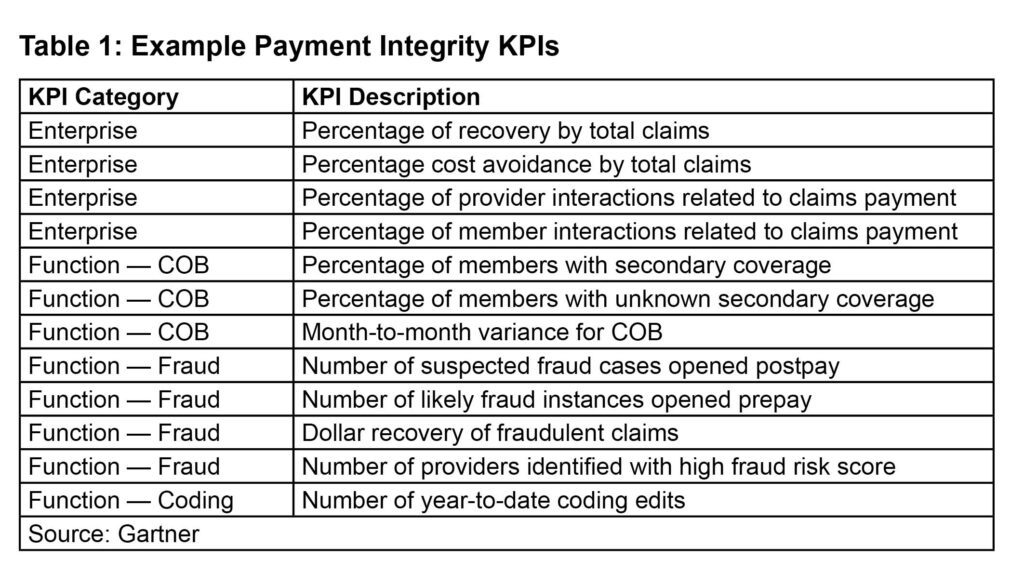

Using Empathy to Set KPIs

When deciding your quarter or yearly initiatives it is important to leverage empathy and consider what frustrations your teams are facing. If you don’t know what barriers are for your employee’s success, ask them.

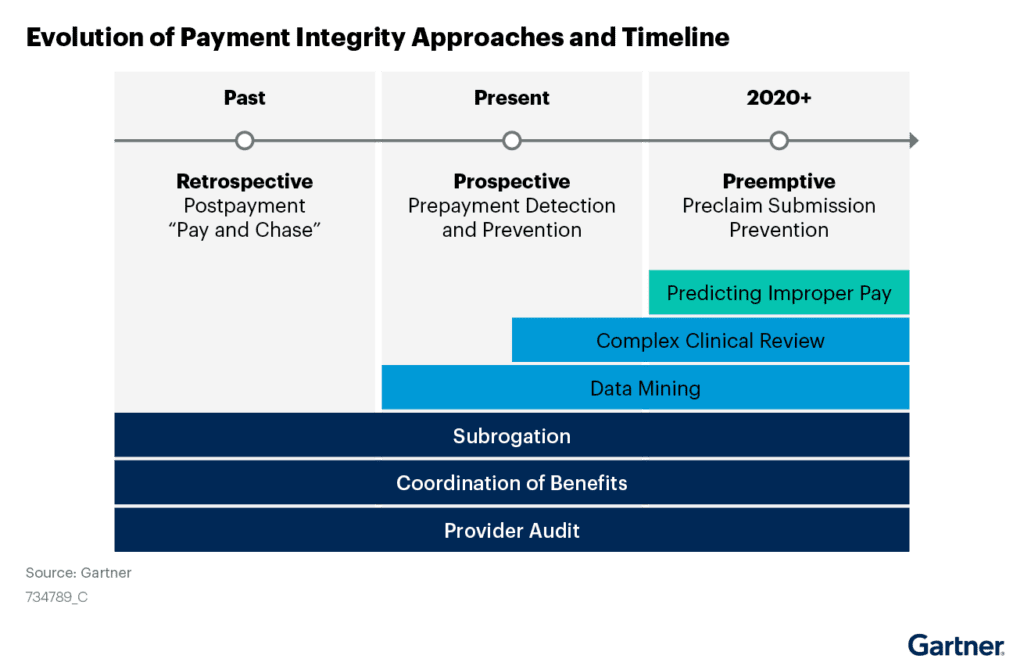

One of the most challenging parts of working in healthcare is information sharing and ever-changing policies. This may be a great starting place for empathetic KPIs.

Developing empathy in the workplace is a potent way to empower your team to perform better, have stronger bonds with the organization, and be more committed to the company mission.