Is it possible? Can competitors also collaborate? Do they already? When is it acceptable? When does it push reasonable boundaries and when does it cross the line? This post will cover those thoughts and others surrounding the value of ‘collaborative competition’.

In a recent in-person discussion with multiple customers, some competing for market share within the same geographic region, we were told, admonished really, that we (the ‘vendor partner’) worry more about their competition than they do – and they would find value and appreciate the opportunity to collaborate more.

I’ve been in the health plan business since 1990 and reflecting on the 90s when managed Medicare was beginning to grow, then regulated by the Health Care Financing Administration (HCFA), a predecessor to CMS, fierce competition quickly followed. Health plans offering Medicare coverage within the same geographic region became strong competitors. At the time, competition was based on the variety of benefits offered, co-pays and co-insurance, and most apparent, the premiums.

Very shortly afterwards, premiums dropped dramatically, and zero premium plans surfaced and became commonplace. No longer was competition based on premium – shifting to benefits and member/beneficiary out-of-pocket cost. This has remained a competitive factor for the past almost 30 years, and in more recent history, individualized customer care/service, predictability of cost, and quality (effectively, “The Triple Aim”), sometimes now Quadruple or Quintuple (often adding staff satisfaction and equity).

Competition in the markets of Medicare as well as Medicaid and Commercial remain a focus for health plans today. This was confirmed earlier in 2022 when HealthEdge commissioned an independent study of over 300 health insurance executives on a variety of topics. Competitive pressure was selected as a top challenge by 35% of executives responding, ranking fifth. Competition also showed up regarding member acquisition, with 23% of respondents listing this as a top concern. However, when reviewing the responses regarding technology, competition did not appear in the results. Instead, investments in technology and alignment of business and IT were consistently the top two technology goals – with 53% of executives confirming. An opportunity for collaboration exists here.

All health plans must efficiently operationalize in essentially the same manner – and utilize similar internal processes. Some developing processes, for example, the approach to handling value-based care, remain competitive. During the past couple decades, competition has increased within the health plan marketing environment – with various marketing solutions offering competitive advantages for capturing increased market share. Typically, marketing is managed separately from the core operations within a health plan. Does this make operational collaboration more reasonable? Many would say yes.

Take provider data as an example. It’s not unreasonable to conclude that 100% of health plans have some challenges in managing their provider data. Health plans within the same geographic region often have very labor-intensive processes surrounding activities such as credentialing. Some geographic regions, even some entire States, have established a variety of credential verification services – a “one-stop-shopping” approach, per se, to ease credentialing for everyone. This is a collaborative solution that benefits everyone in the region yet does nothing to inhibit competition.

Often, health plans have built-in trust issues with their software vendors. Time and effort are required to establish an effective partnership based on mutual understanding and common goals. While this trust and partnership is being established and built, health plans can find common ground with one another. As with any challenge in life, we all know that we’re rarely the first to experience something – and the collective experience of others can help to address any challenge. Customers with common solutions can share experiences, tips and tricks, hacks. And we all know everyone hates to open a ticket. How nice to address an issue without that. Do you contact Apple® support for questions regarding your iPhone®? More than likely, you find the nearest teenager! Health plans, even competitive ones, can commiserate, communicate, and collaborate as they have the same challenges. There is strength in numbers – solving a challenge together is more effective that going it alone. Networking with others within our small world also has many unintentional benefits.

My answers to the initial questions posed… Is it possible to collaborate in a competitive marketplace? Yes, it is possible! Yes, competitors can also collaborate (sometimes)! And yes, some already are! When is it acceptable? More often than some think! When does it push the reasonable boundaries and/or cross the line? When using similar solutions, far less frequently and rarely crosses any inappropriate lines.

A way to begin to establish new collaborative relationships is also through customer user groups. If you’re not already connected to your HealthEdge product user group, use this link to register for the user groups of your choice. If you are already a HealthEdge customer, feel free to also contact your HealthEdge Account Executive who can guide you as needed. Go forth and collaborate!

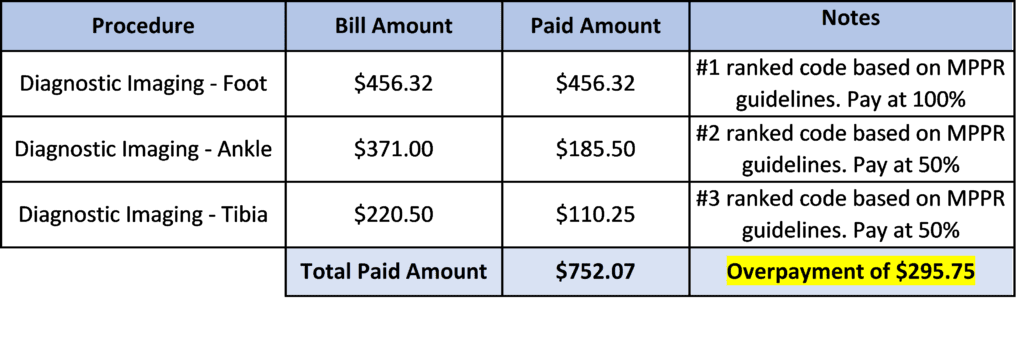

At HealthEdge, disrupting the status quo is part of who we are. When it comes to redefining payment integrity, we often think about it in terms of shifting from a

At HealthEdge, disrupting the status quo is part of who we are. When it comes to redefining payment integrity, we often think about it in terms of shifting from a