Improper claims payment and fraud contribute more than $200 billion to the annual cost of U.S. healthcare.1

Summary

- In order to generate cost savings, most U.S. healthcare payers:

- Focus on retrospective pay-and-chase processes.

- “Stack” complicated and non-interoperable payment integrity solutions from multiple vendors.

- These practices generate provider and member friction, ineffective workflows and limited business transparency.

- More effective prospective solutions to prevent inaccurate claims payment are available today.

- These solutions have yet to be widely implemented due to competing stakeholder interests.

- Implementation of prospective solutions will be achieved when stakeholders align on:

- The total impact of ineffective claims processes.

- Clear KPIs for prospective solutions.

- Vendor RFP evaluation.

How Big is the Payment Integrity Problem?

According to Gartner research, 3%-7% of all commercial U.S. health plan’s paid claims dollars have payment integrity problems.

Widespread payment integrity issues have been acknowledged by political leaders like Assistant Inspector General as well as in research. Estimated improper payments by Medicare and Medicaid are expected to exceed $88 billion annually. As well, the total cost of fraud alone is estimated at over $200 billion annually.1

In recent years payment integrity issues have only worsened. This is primarily due to COVID-19’s underlying waivers and temporary regulatory changes for providers.

For example, Humana filed a lawsuit against telehealth company QuivvyTech for allegedly false pharmacy claims.

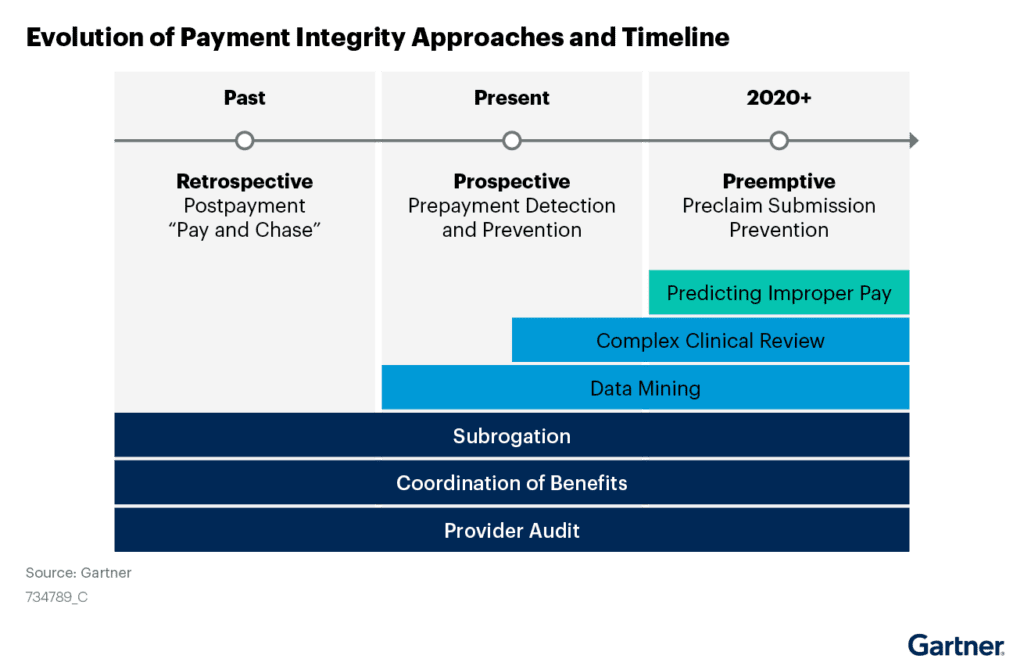

How have Health Plans Addressed Payment Integrity?

Today, payer CIOs support an array of payment integrity solutions. These are usually a mix of internal manual review processes and complicated vendor software.

The traditional organizational approach to payment integrity is to:

- Pay providers without question.

- Have both internal and external teams engage in “stacking”. (“Stacking” is retrospectively analyzing claims for inaccuracies multiple times.)

- Chase providers for these improper payments.

Compared to a prospective approach, traditional approaches:

- Recover only a fraction of would be recovered with a prospective approach.

- Accrue significant associated administrative and reputational costs.

Instead, prospective payment solutions provide exponentially increased financial performance as well as improved provider relationships.

Why Invest in Prospective Payment Solutions Now?

In 2022, unique market forces make prospective payment solution investment an imperative for health plan survival. This includes financial pressures due to:

- Pandemic-related coding and billing conditions

- Exceptions to medical and payment policies

- Ongoing “payvider” convergence and cross-industry acquisitions

Gartner not only is encouraging payors to adopt a prospective approach to fraud, waste and abuse management today, but has been doing so for years. In fact, prospective payment approaches were analyzed by Gartner as early as 2017, and have been included in Gartner’s Hype Cycle since 2019. and 2020.

How to Invest in Payment Solutions Today

Implementing prospective payment solutions has been challenging because it requires buy-in from stakeholders across the health plan enterprise.

CIOs should work with these stakeholders to:

- Objectively conduct a cost-benefit analysis on current “stacking” strategies vs prospective payment solutions

- Issue an RFP and evaluate current or possible vendor capabilities for improving cost avoidance as well as enhancing business and provider partnerships

Learn more about how HealthEdge has been named as a Sample Vendor for Prospective Payment Integrity (PPI) solutions in the Gartner Hype Cycle for U.S. Healthcare Payers, 2022.

1Gartner, Adopt Prospective Payment Integrity to Thwart Healthcare Fraud and Improper Claims Payment, February 16, 2022

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.