Tri Agencies published a Frequently Asked Questions (FAQ) document on August 20, 2021, addressing the Transparency in Coverage (TiC) Machine-Readable Files (MFRs) and much of the transparency and consumer protections in the Consolidated Appropriations Act (CAA). This signaled the intent to take a more methodical and intentional approach to the rulemaking and acknowledged that the components are more complex than first blush.

Machine-Readable Files (MFRs)

First, they looked at the requirement for all non-grandfathered plans to post three MFRs to their public website by January 1, 2022. They deferred enforcement for In-Network Rates and Allowed Amount files―the two categories that HealthEdge plays a part in―to July 1, 2022, for complete compliance. Regardless, we’re staying on schedule and developing the utilities in-process for these two files and are targeting a release date in Q4.

The Tri Agencies also delayed, until future rulemaking, the prescription drug machine-readable file requirement due to disparities between the various prescription drug rules.

Price Comparison Tool

The FAQ also impacts the CAA requirement for group health plans to make a Price Comparison Tool available online or by phone. The Tri-Agencies acknowledged that this requirement is essentially a duplicate of the TiC Online Shopping Tool, except that it adds the ability to access by telephone. To better align the shopping tools, the Tri Agencies delayed enforcement until January 2023.

Advanced Explanation of Benefits (A+EOB)

A+EOB will require the provider to send a good faith estimate of an upcoming service a member is scheduled to receive to the health plan. The plan will then process it, much as they would process any claim, except that it’s a trial claim―and that’s what HealthEdge is going to be enhancing.

The Tri Agencies cited the complexity of the development around the standards for the good faith estimate and the communication from provider to plan. They intend to issue a notice of proposed rulemaking along with a comment period. So, we will not see enforcement on January 1 of 2022, until the rulemaking process is complete.

HealthEdge is collaborating with clients and working through discovery and solutioning, and identifying enhancements we can make to our trial claim functionality to accommodate the A+EOB along with the Price Comparison Tool.

Interoperability and Transparency

Although not included in the FAQ, beginning on July 1, 2021, the Patient Access and Provider Directory APIs went into effect. HealthEdge published material on the patient access data mapping for the API. This data mapping can also be used for the payer-to-payer data exchange, which goes into effect on January 1, 2022. This rule will allow members to request up to five years of historical data to be digitally sent from their previous plan to their new plan. The patient access data mapping guide provides the data element mapping for the previous health plan to export and send to the new plan.

With a little breathing space from the more calculated implementation of the TiC and the CAA, I expect we will begin to look at ways the historical data will benefit new members; and quickly realize the value in using the historical data to look at the members’ current health stats, identify care gaps, and recommend treatment or preventive care.

Takeaways

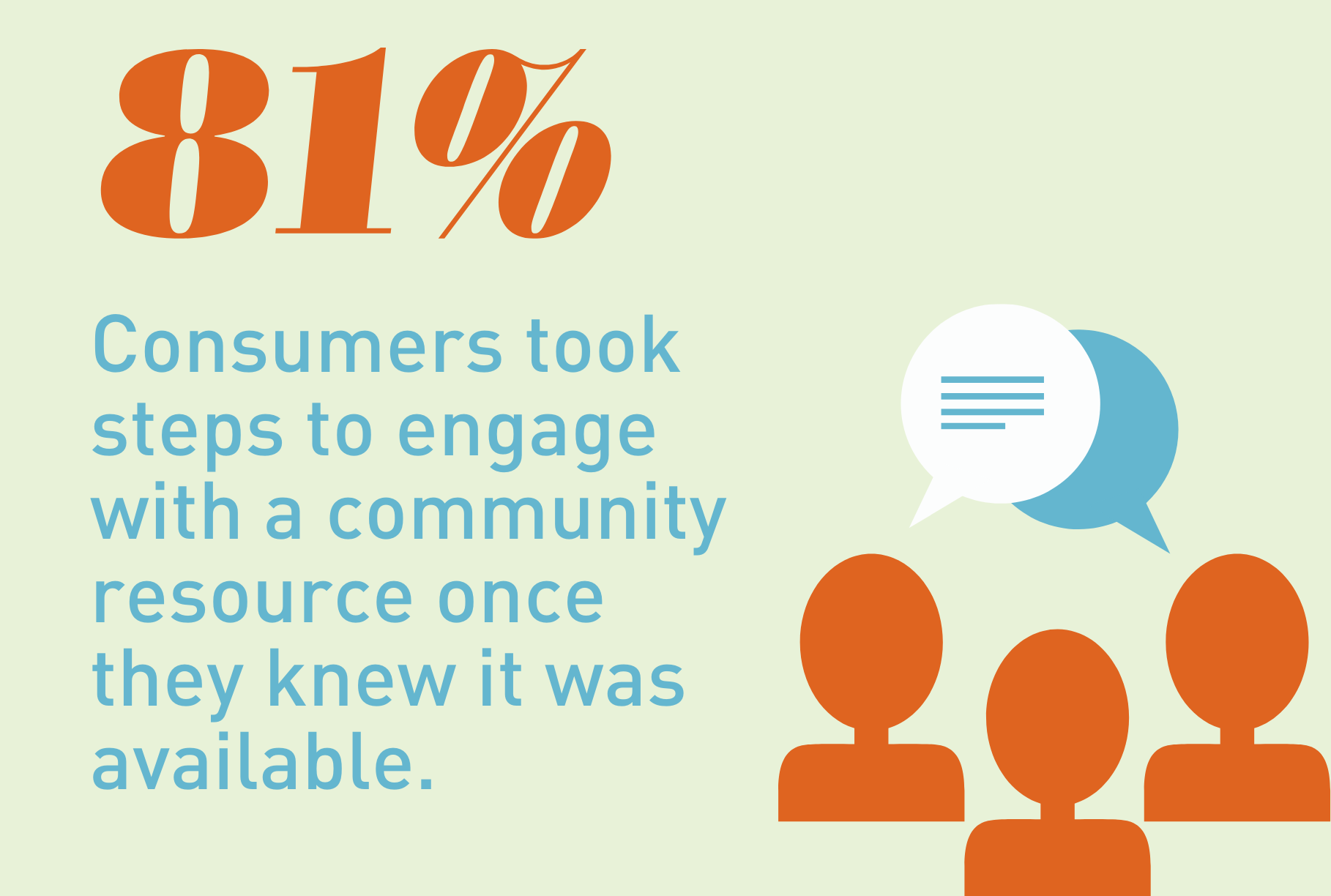

With any compliance mandate, there is a good intention behind it, including the interoperability, transparency, and other consumer protections that we’ve seen come through rulemaking in the last couple of years.

These rules make the healthcare industry more member-centric, with the intent to reduce the overall cost of care by getting members involved in their decision-making. The digital movement of data will help facilitate these efforts; if members know what preventive services they should receive and understand their supplemental benefits, the outcomes should improve.